Are you interested in learning about bear flag trading patterns? If so, you’ve come to the right place! Bear flag patterns are a popular technical analysis tool used by traders to predict future price movements in the stock market.

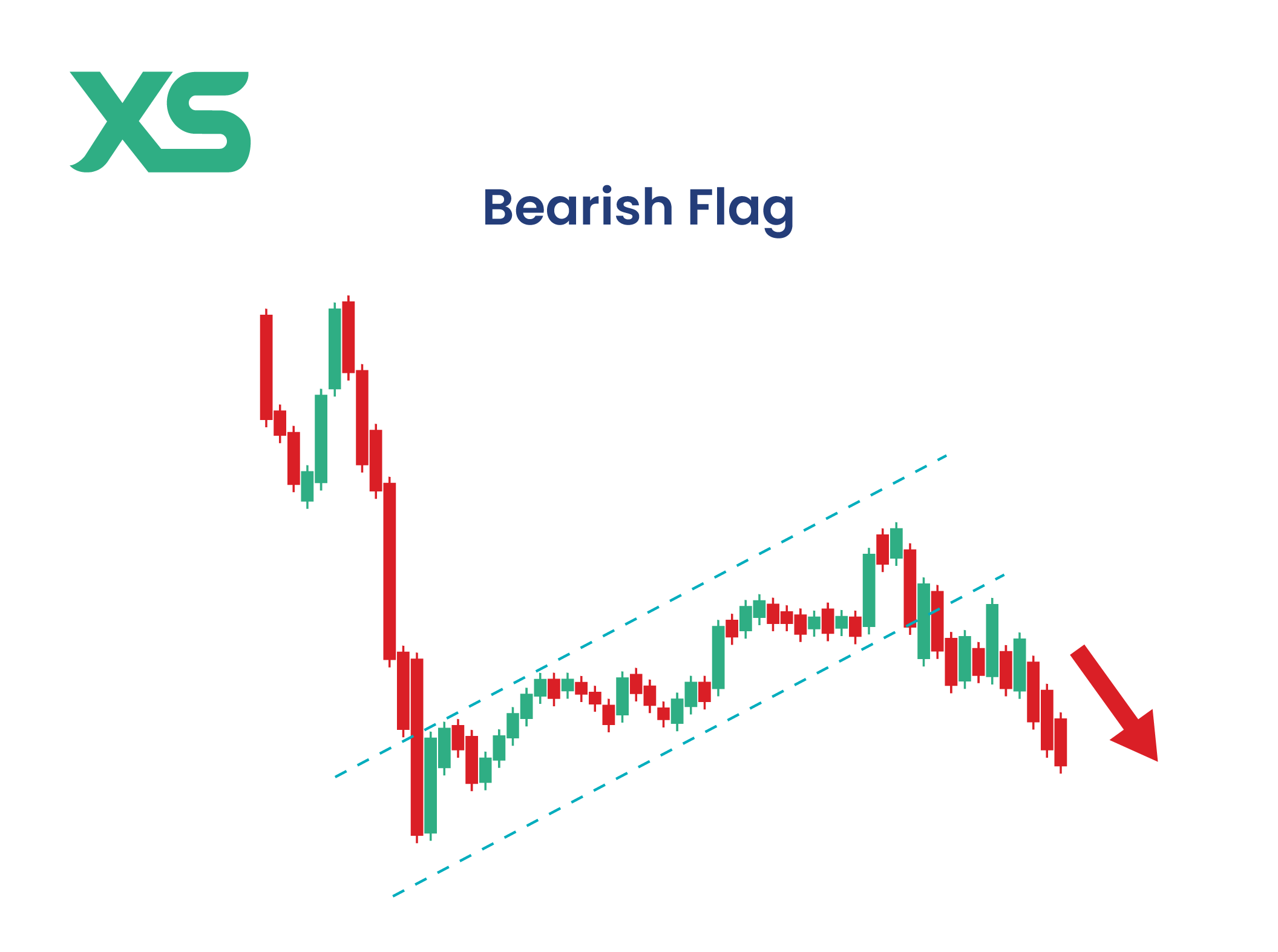

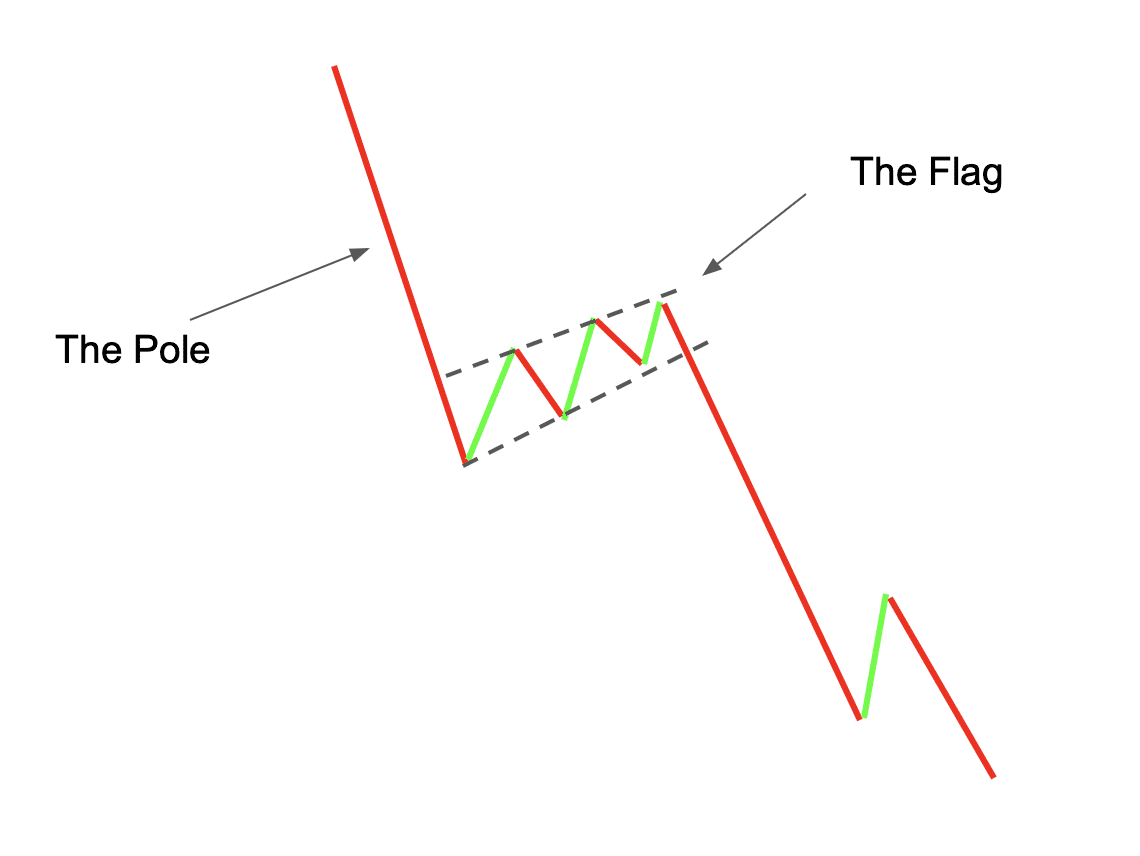

When a bear flag pattern forms, it indicates a temporary pause in a downward trend before the price continues to decline. This pattern consists of a sharp decline in price (the flagpole) followed by a period of consolidation (the flag) before the price drops again.

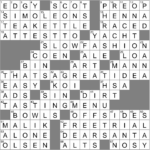

bear flag trading pattern

The Basics of Bear Flag Trading Pattern

To identify a bear flag pattern, look for a significant downward move in price followed by a period of sideways movement. The flag should be sloping upwards slightly, resembling a flag on a flagpole. Once the pattern is confirmed, traders often enter short positions in anticipation of further price declines.

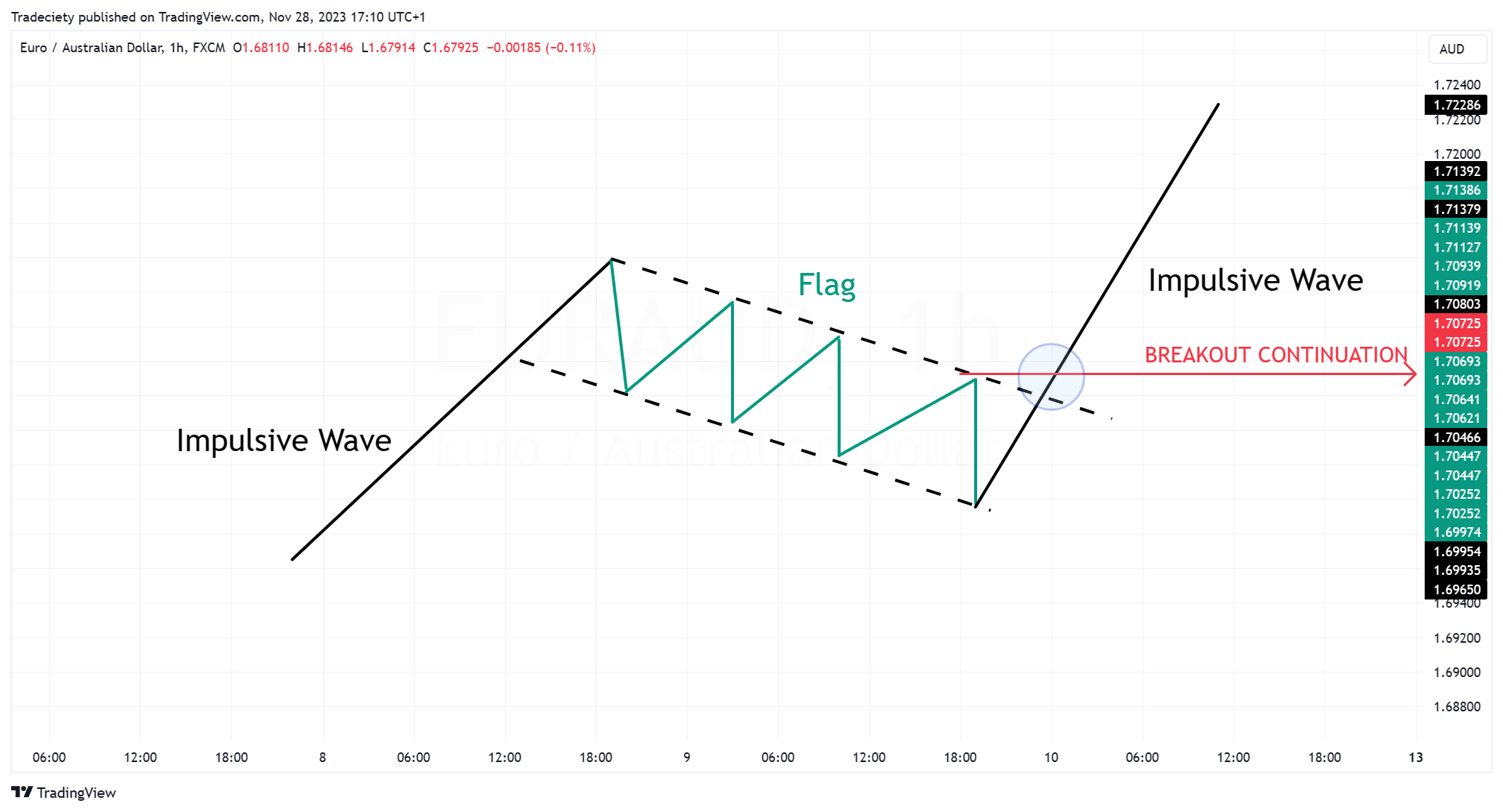

It’s essential to wait for the breakout confirmation before entering a trade based on a bear flag pattern. This confirmation occurs when the price breaks below the lower trendline of the flag, signaling a continuation of the downtrend. Traders typically set stop-loss orders above the flag to manage risk.

While bear flag patterns can be reliable indicators of future price movements, it’s essential to combine them with other technical analysis tools and indicators for confirmation. Remember, no pattern is foolproof, and it’s crucial to manage risk and use proper risk management techniques when trading based on patterns like bear flags.

In conclusion, bear flag trading patterns can be valuable tools for traders looking to profit from short-term price movements in the stock market. By understanding how to identify and trade these patterns effectively, you can improve your trading success and make more informed decisions in the market.

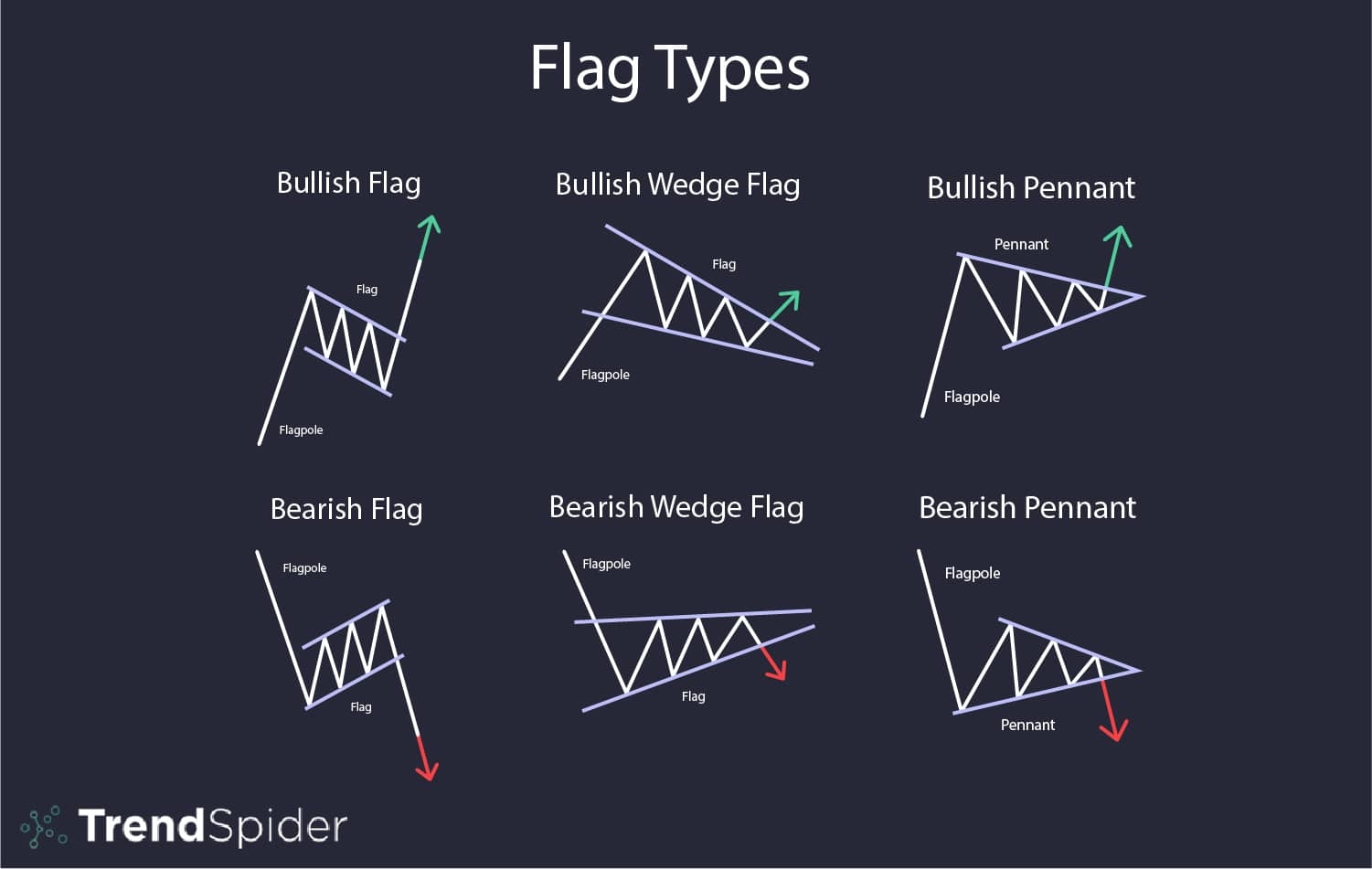

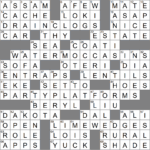

Bull Flag And Bear Flag Trading Explained

Chart Patterns Flags TrendSpider Learning Center

Bull Flag And Bear Flag Trading Explained

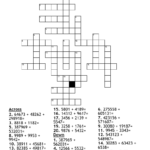

What Is A Bear Flag Pattern

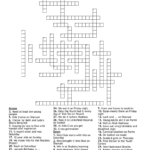

The Bear Flag Trading Strategy Guide