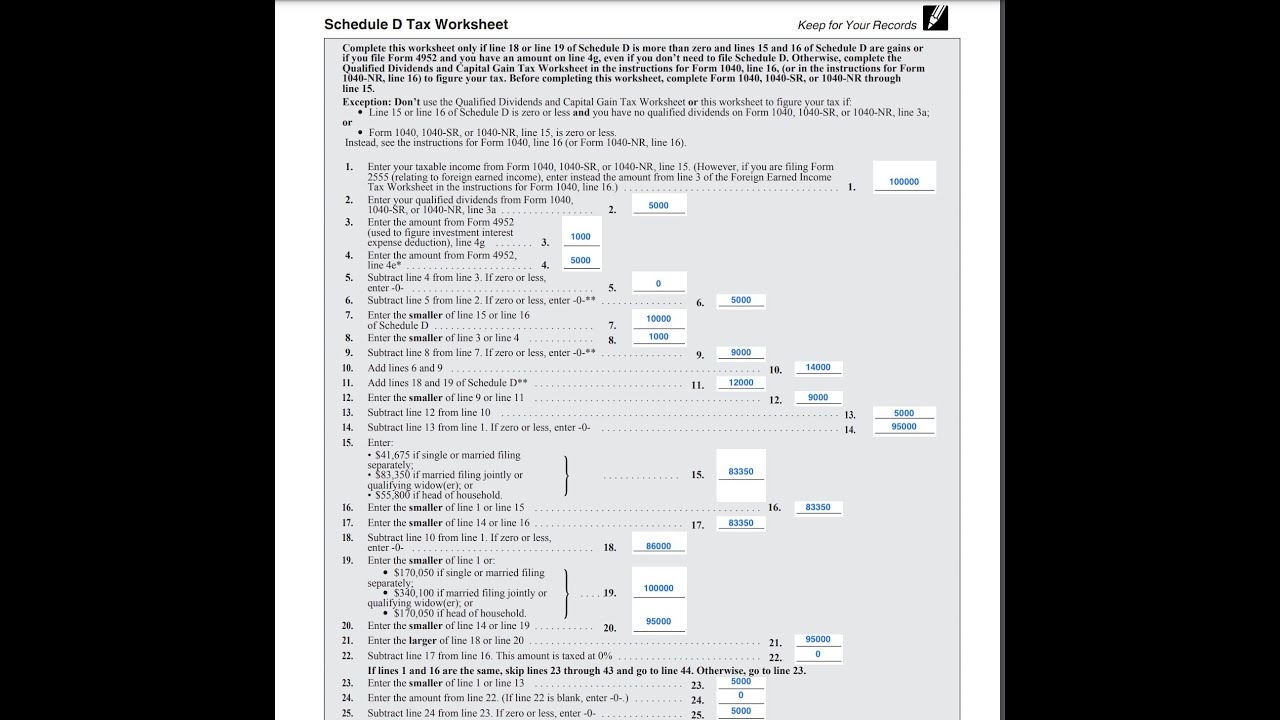

Are you looking for an easy way to organize your taxes this year? The Schedule D tax worksheet might just be the solution you’ve been searching for. This handy tool can help you keep track of your capital gains and losses in a simple and efficient way.

With the Schedule D tax worksheet, you can easily calculate the amount of tax you owe on your investment income. This worksheet is especially useful if you have multiple investments or if you’ve bought and sold stocks throughout the year. It can help you stay organized and make tax time less stressful.

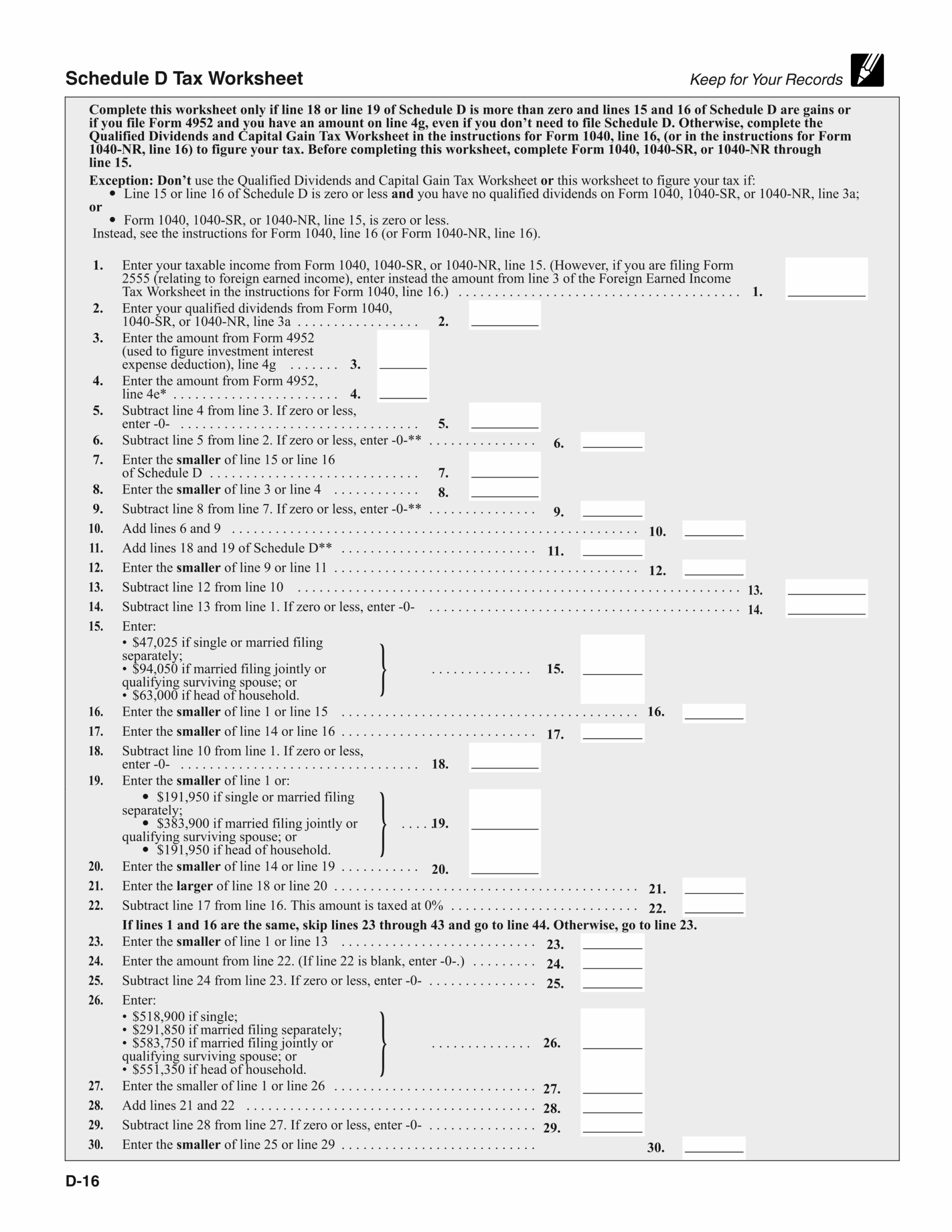

sch d tax worksheet

The Benefits of Using the Schedule D Tax Worksheet

One of the main benefits of using the Schedule D tax worksheet is that it helps you keep track of all your investment transactions in one place. This can save you time and hassle when it comes to filing your taxes. Additionally, the worksheet can help you identify any potential tax deductions or credits that you may be eligible for.

Another advantage of using the Schedule D tax worksheet is that it can help you avoid errors on your tax return. By keeping detailed records of your investment transactions, you can ensure that you are reporting the correct information to the IRS. This can help you avoid any potential audits or penalties down the road.

In conclusion, the Schedule D tax worksheet is a valuable tool for anyone with investment income. By using this worksheet, you can stay organized, save time, and potentially lower your tax bill. So why not give it a try this tax season and see how much easier it can make your life?

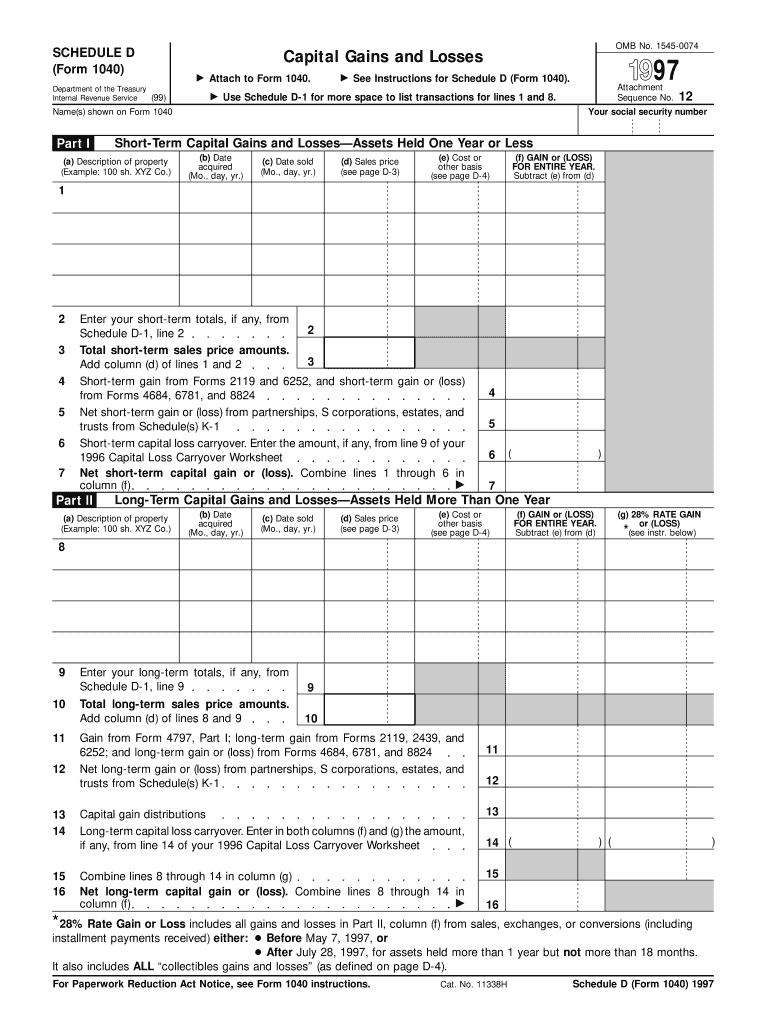

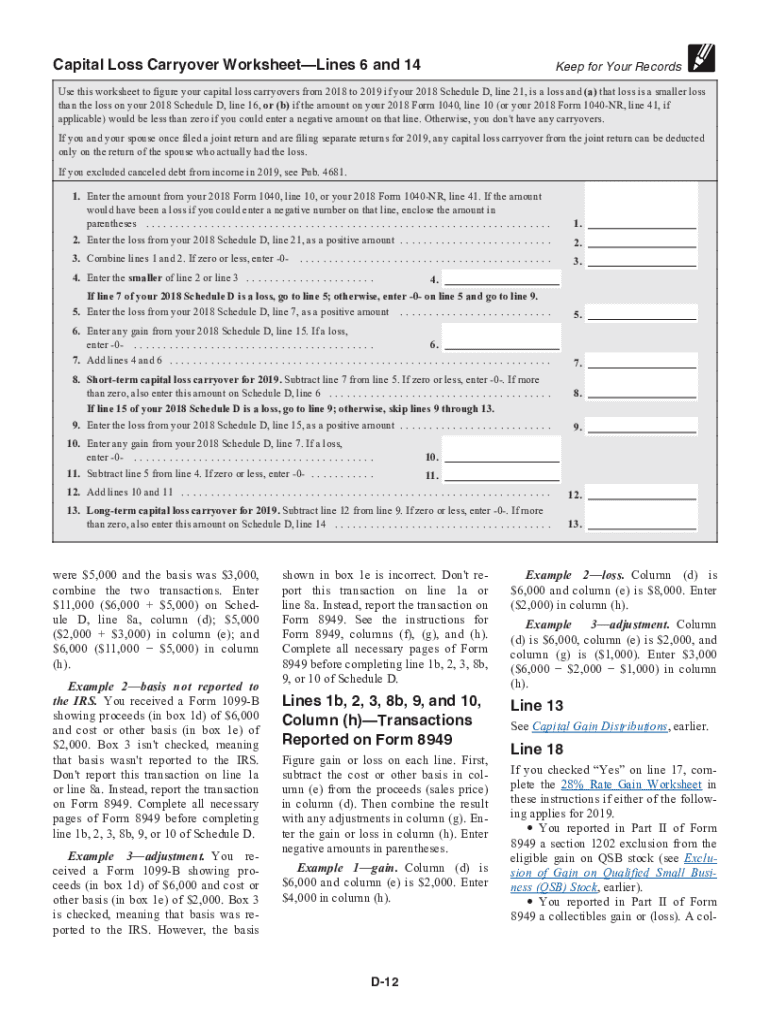

Schedule D Instructions Fill Out Sign Online DocHub Worksheets Library

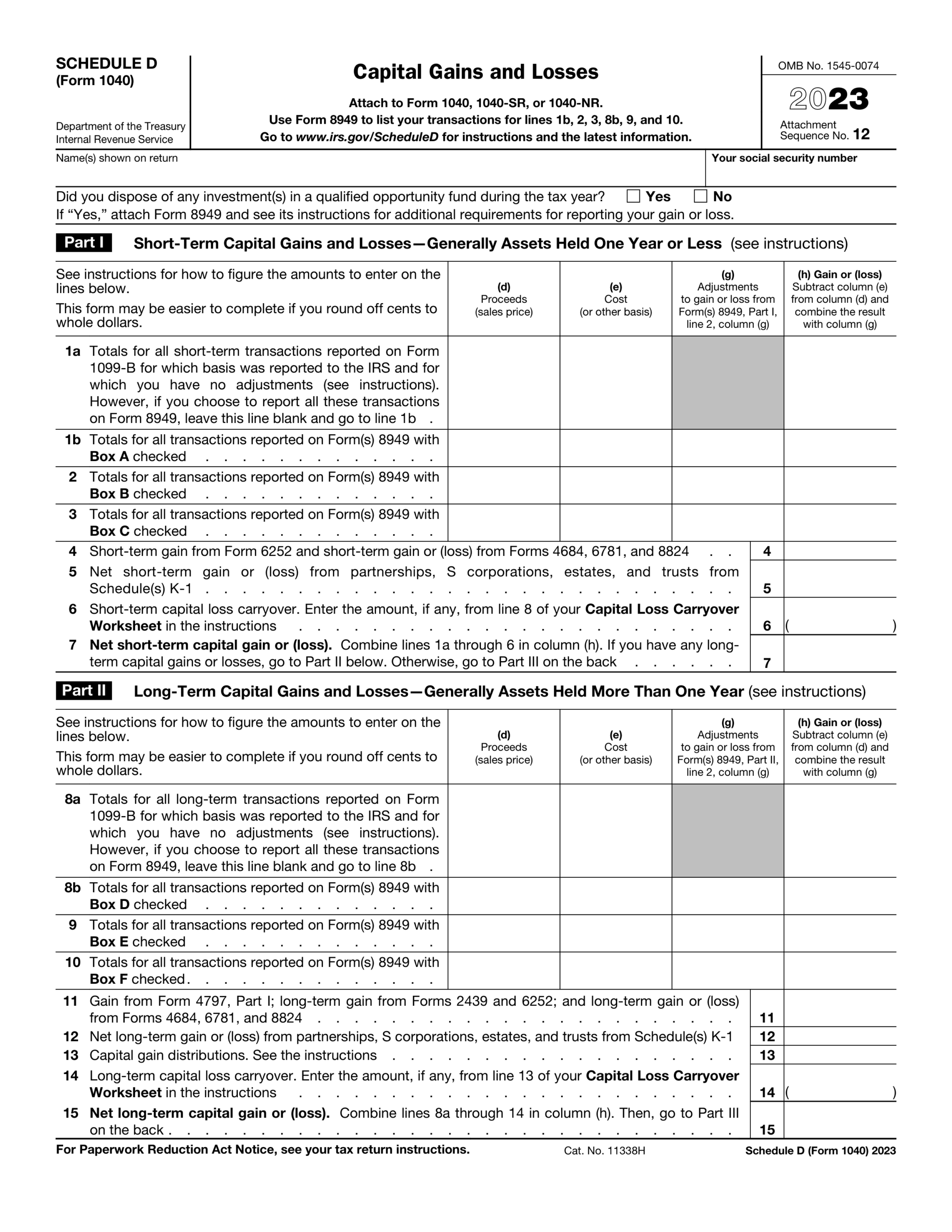

IRS Schedule D Instructions Capital Gains And Losses

IRS Schedule D Instructions

Schedule D Tax Worksheet Walkthrough YouTube

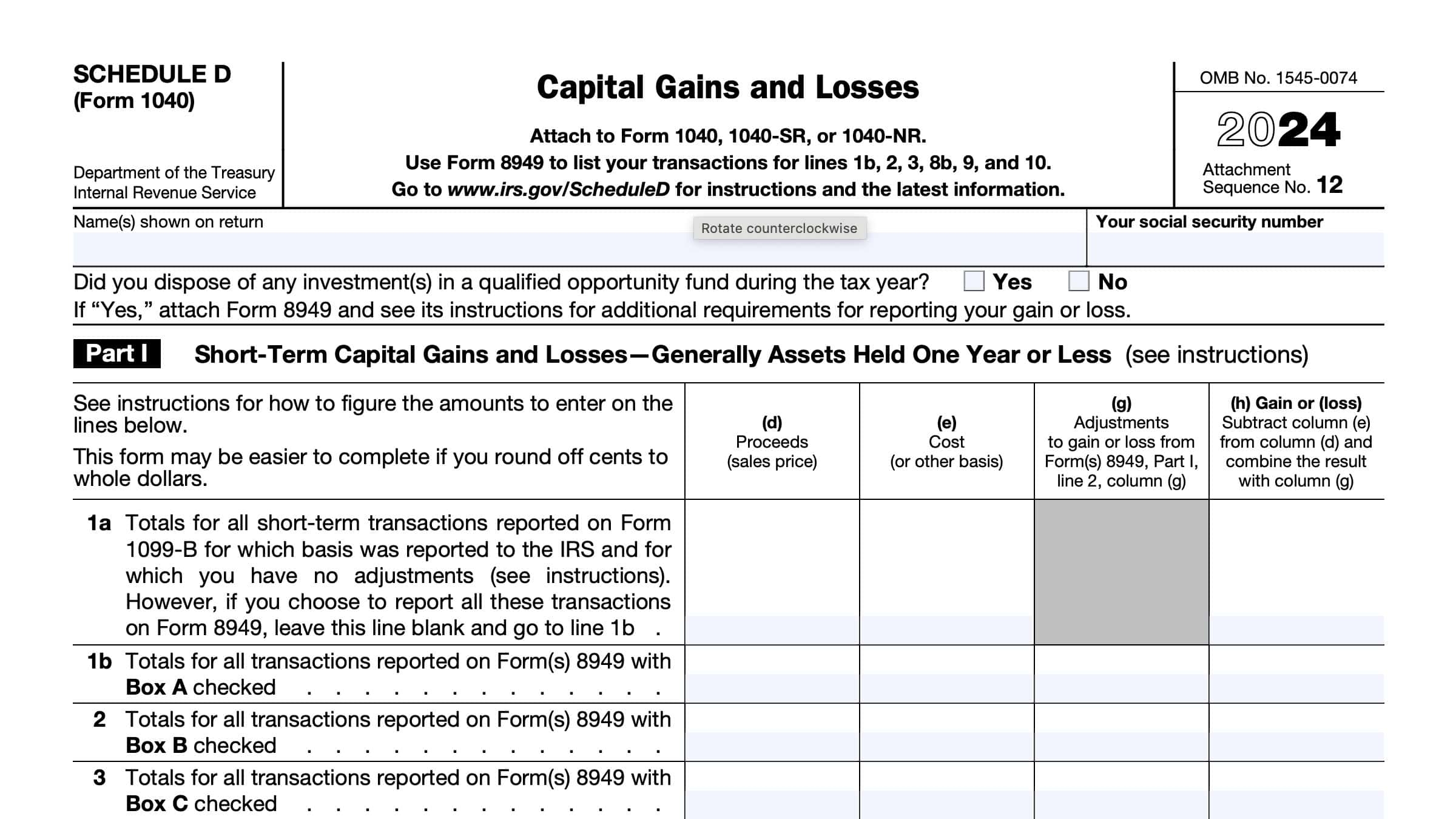

Schedule D Form 1040 2024 2025 Fill And Edit Online PDF Guru