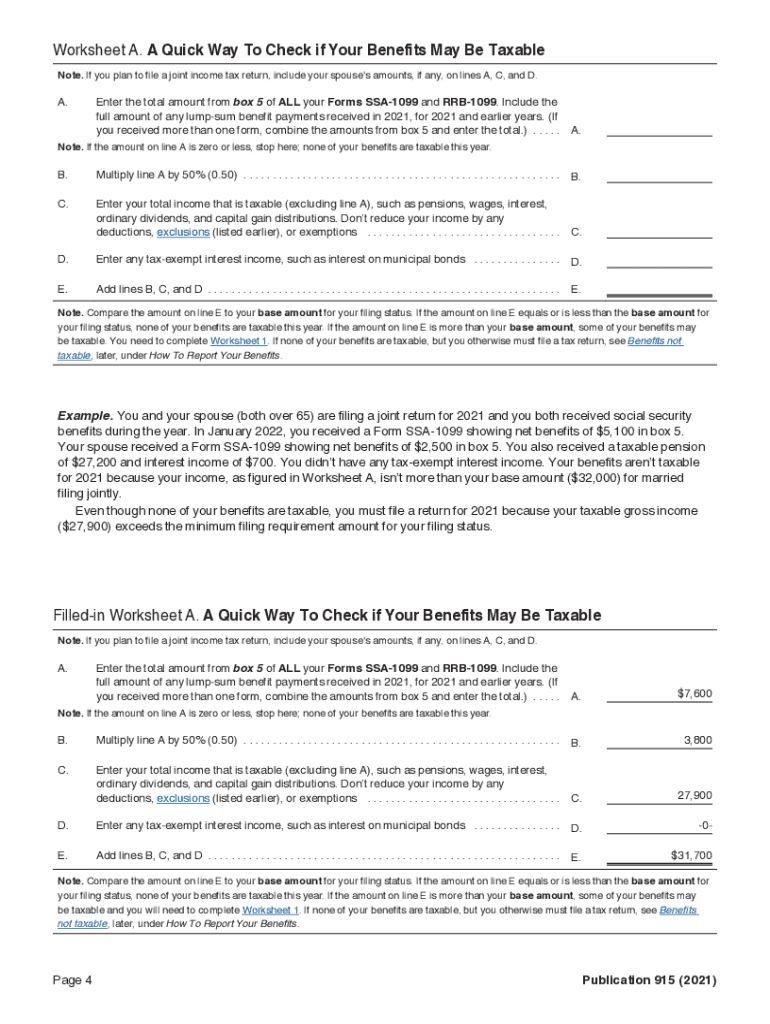

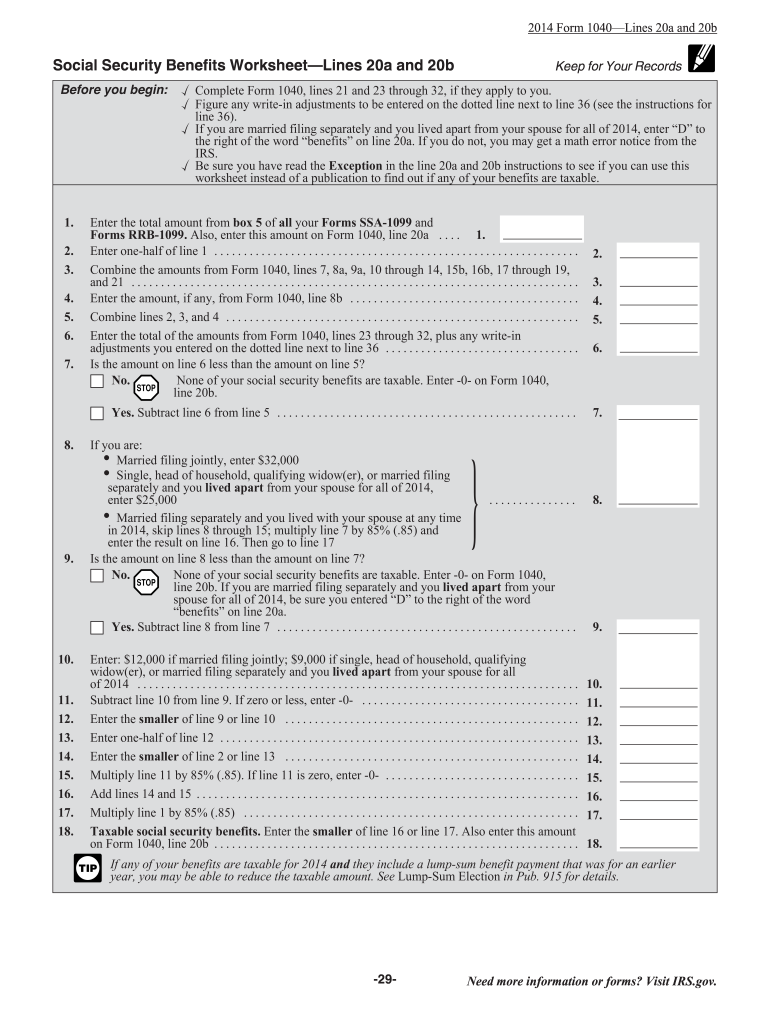

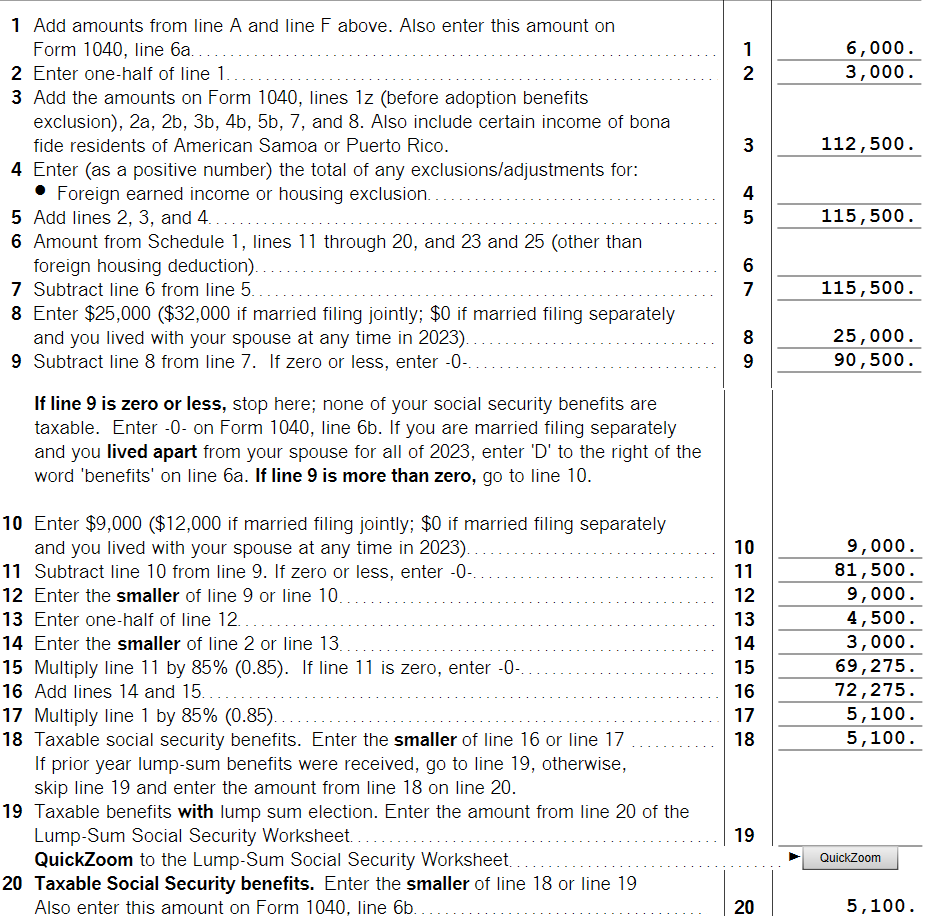

Thinking about your social security taxable income worksheet can be stressful, but don’t worry, we’re here to help break it down for you. Understanding how your social security benefits are taxed is important for planning your finances.

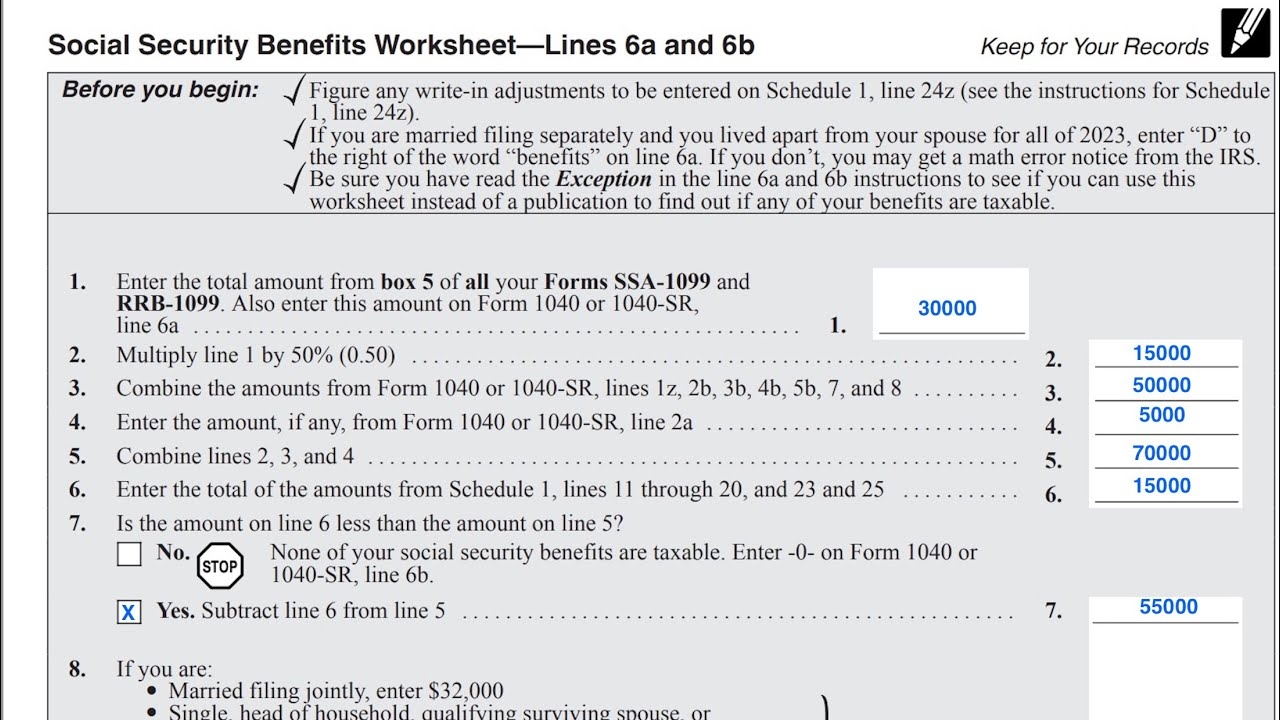

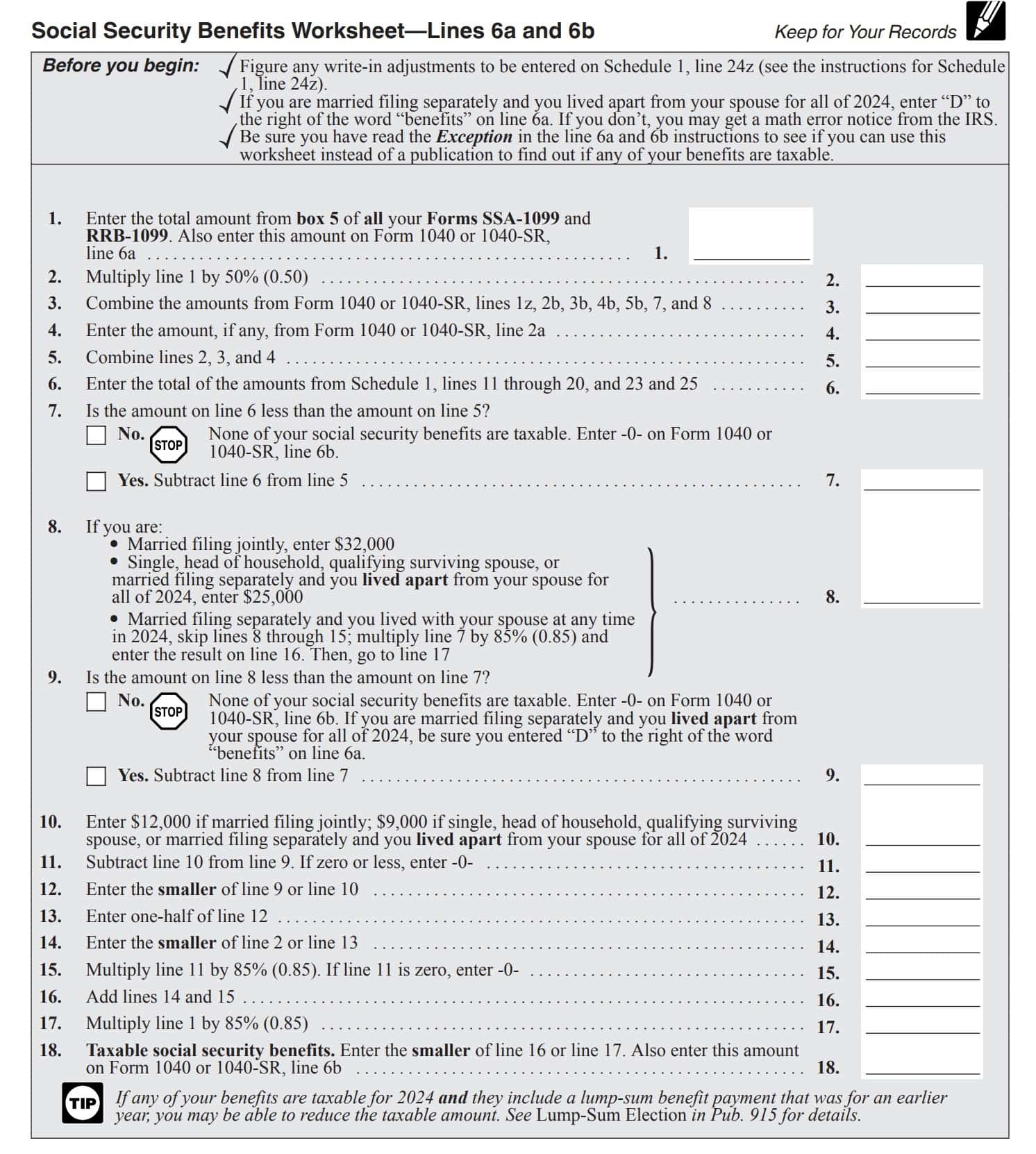

Did you know that up to 85% of your social security benefits could be subject to income tax? That’s where the social security taxable income worksheet comes in handy. It helps you calculate how much of your benefits are taxable based on your total income.

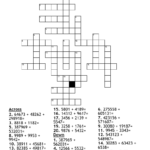

social security taxable income worksheet

Maximizing Your Social Security Benefits

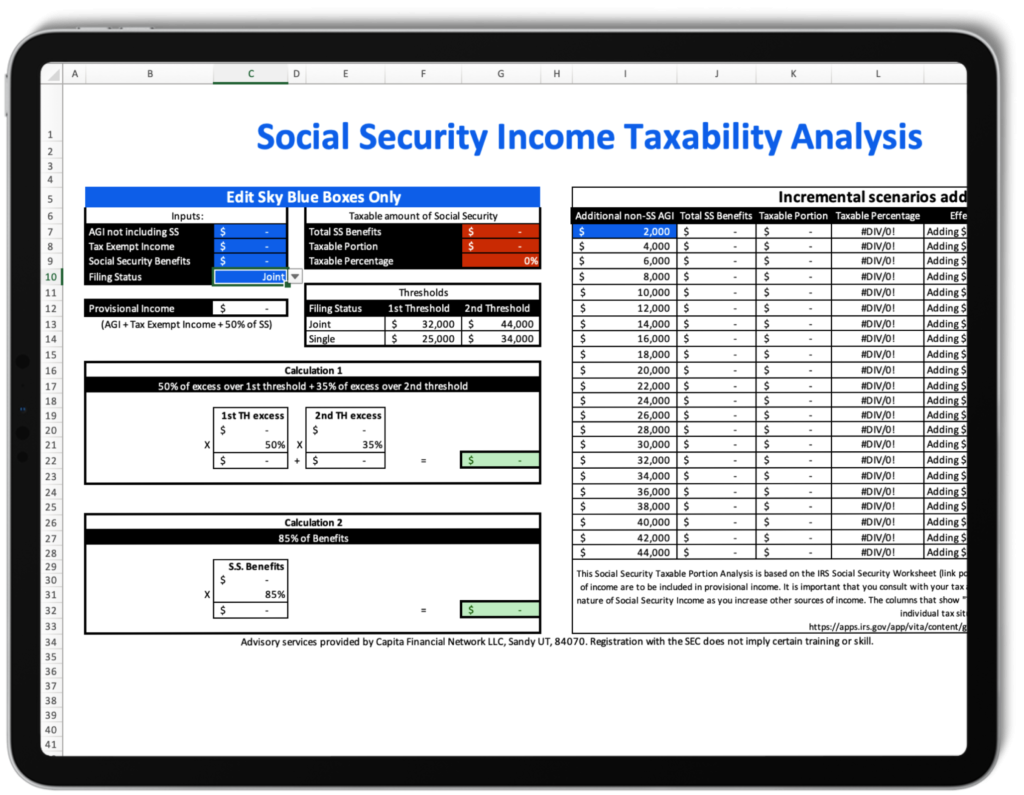

By using the social security taxable income worksheet, you can determine the taxable portion of your benefits and plan accordingly. It’s essential to know how changes in your income can impact the taxation of your social security benefits.

One key strategy to minimize taxes on your social security benefits is to manage your income sources effectively. By spreading out your income over different accounts or years, you can potentially reduce the taxable portion of your benefits.

Consulting with a financial advisor or tax professional can also be beneficial in optimizing your social security benefits and minimizing your tax liability. They can provide personalized advice based on your individual situation and help you make informed decisions.

Don’t let the complexities of social security taxation overwhelm you. With the right tools and guidance, you can navigate the process with confidence and make the most of your hard-earned benefits. Remember, understanding your social security taxable income worksheet is the first step towards financial security in retirement.

Social Security Benefits Worksheet Walkthrough IRS Form 1040 Lines 6a 6b Worksheets Library

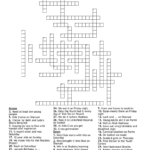

Form SSA 1099 Instructions Social Security Benefits

Social Security Worksheet The Retirement Nerds

Social Security Worksheet Pdf Fill Out Sign Online DocHub

Solved Taxable Social Security Worksheet