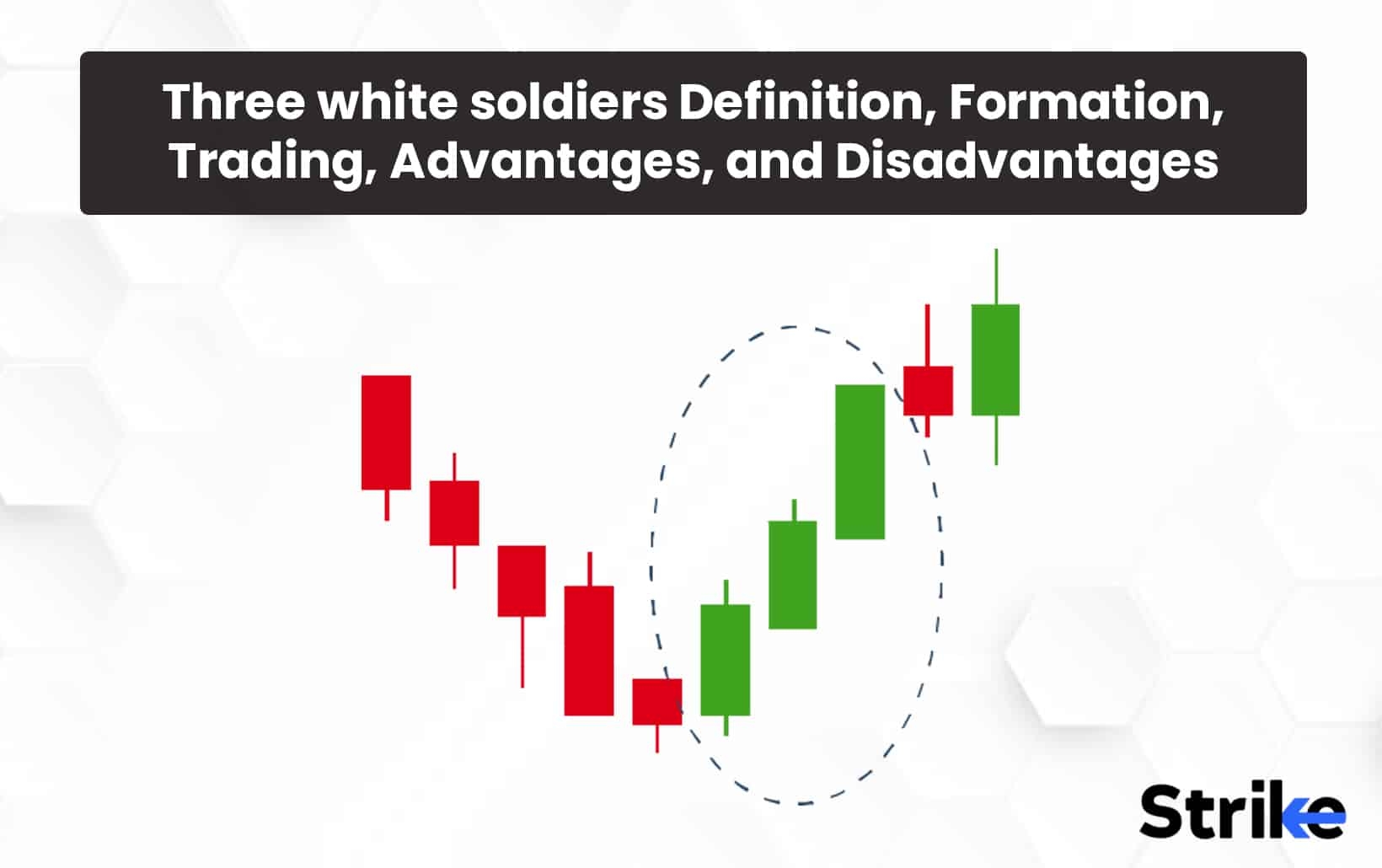

Are you looking to learn more about the three white soldiers candlestick pattern rules? You’ve come to the right place! This pattern is a bullish reversal signal that can help traders identify potential buying opportunities in the market.

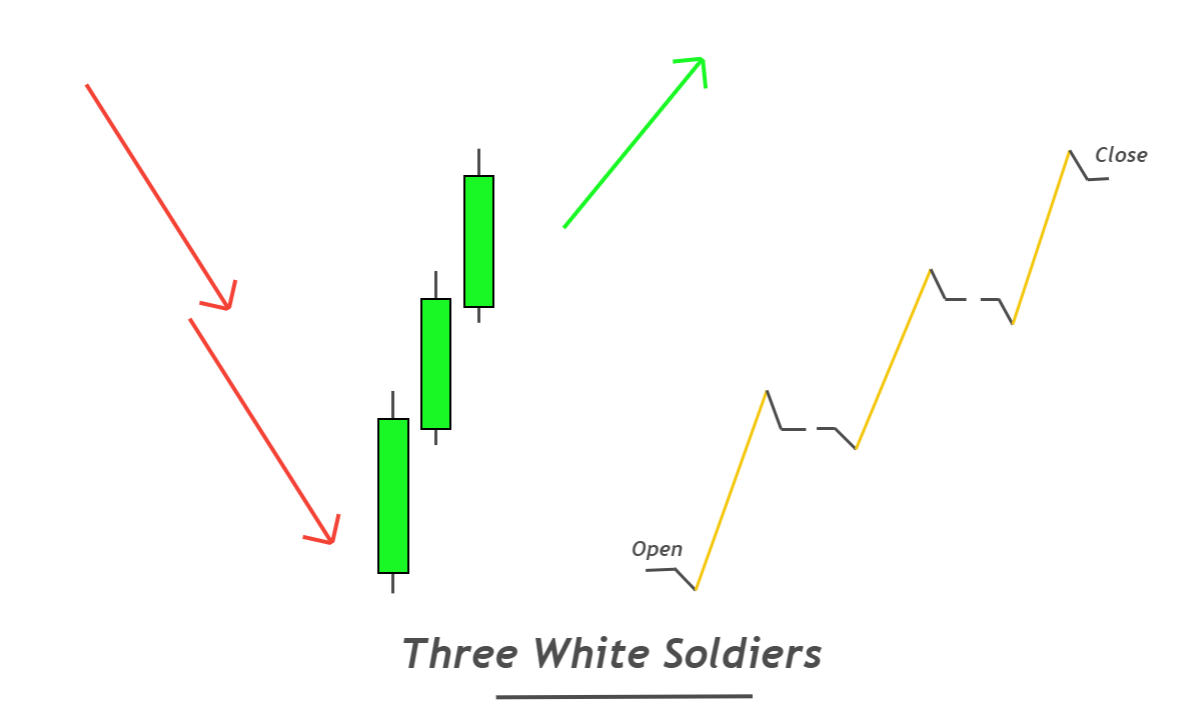

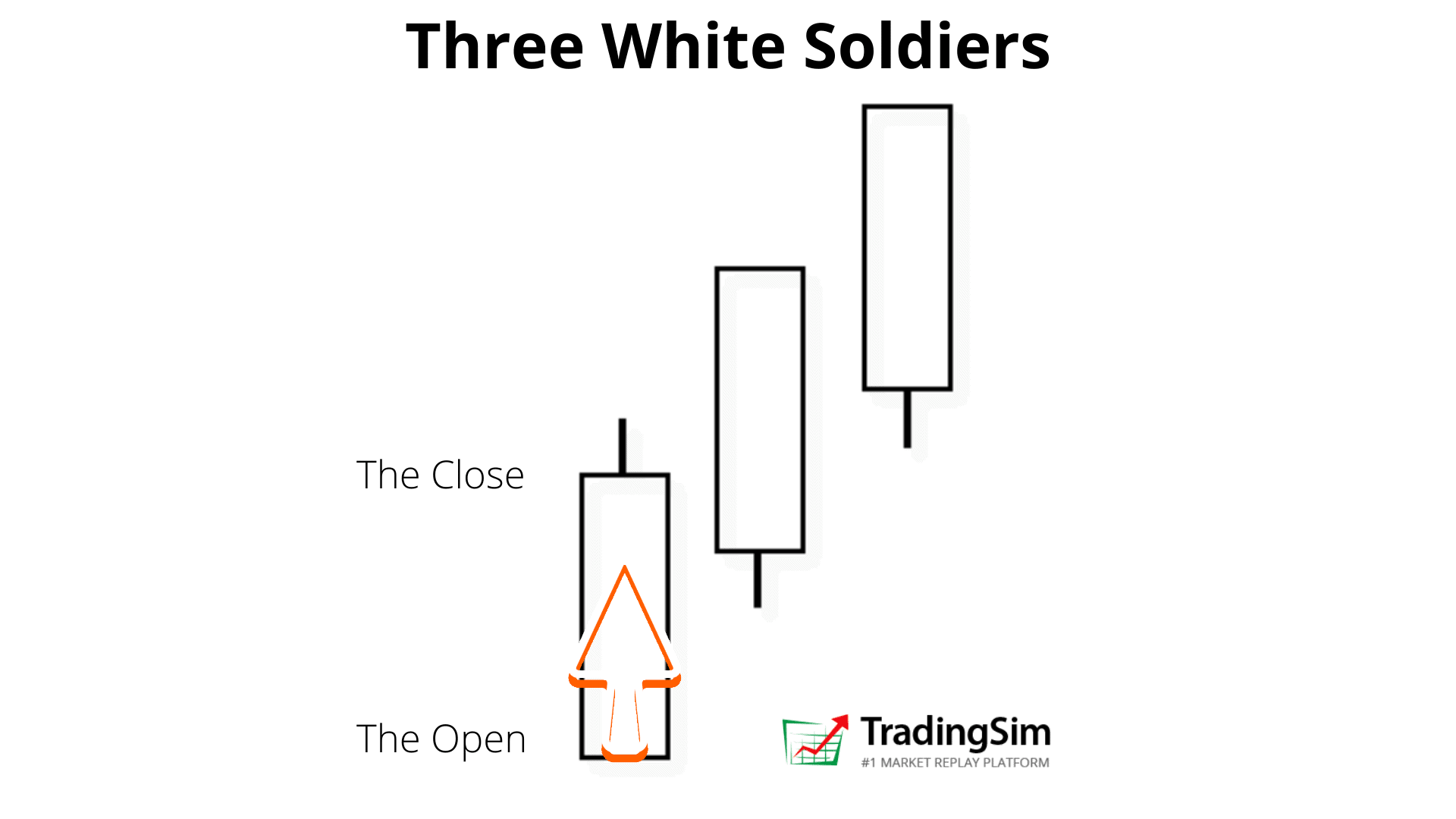

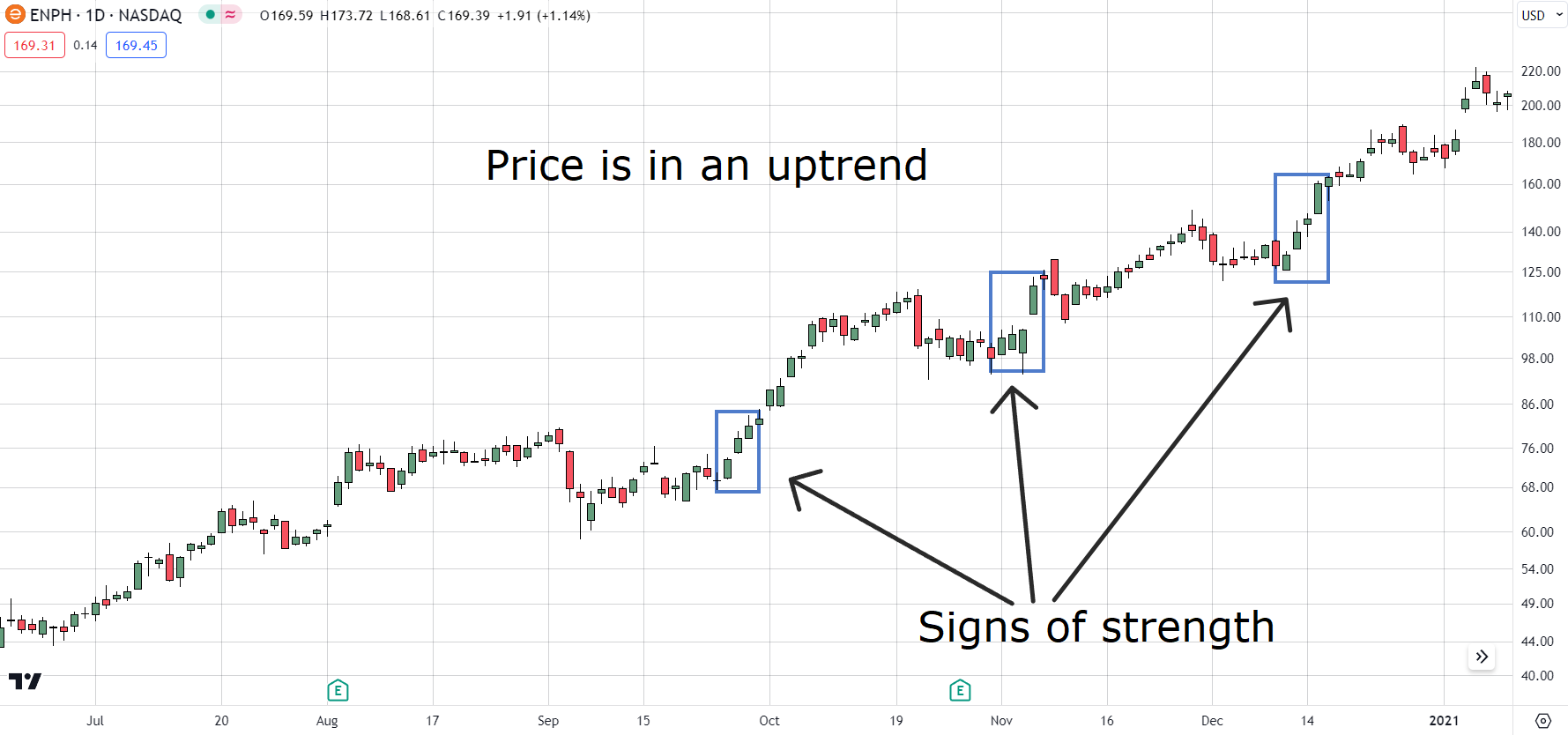

When three consecutive bullish candles appear on a chart, it signals a strong uptrend may be forming. This pattern is characterized by each candle opening higher and closing even higher than the previous one, indicating increasing buying pressure and momentum.

three white soldiers candlestick pattern rules

Understanding the Three White Soldiers Candlestick Pattern Rules

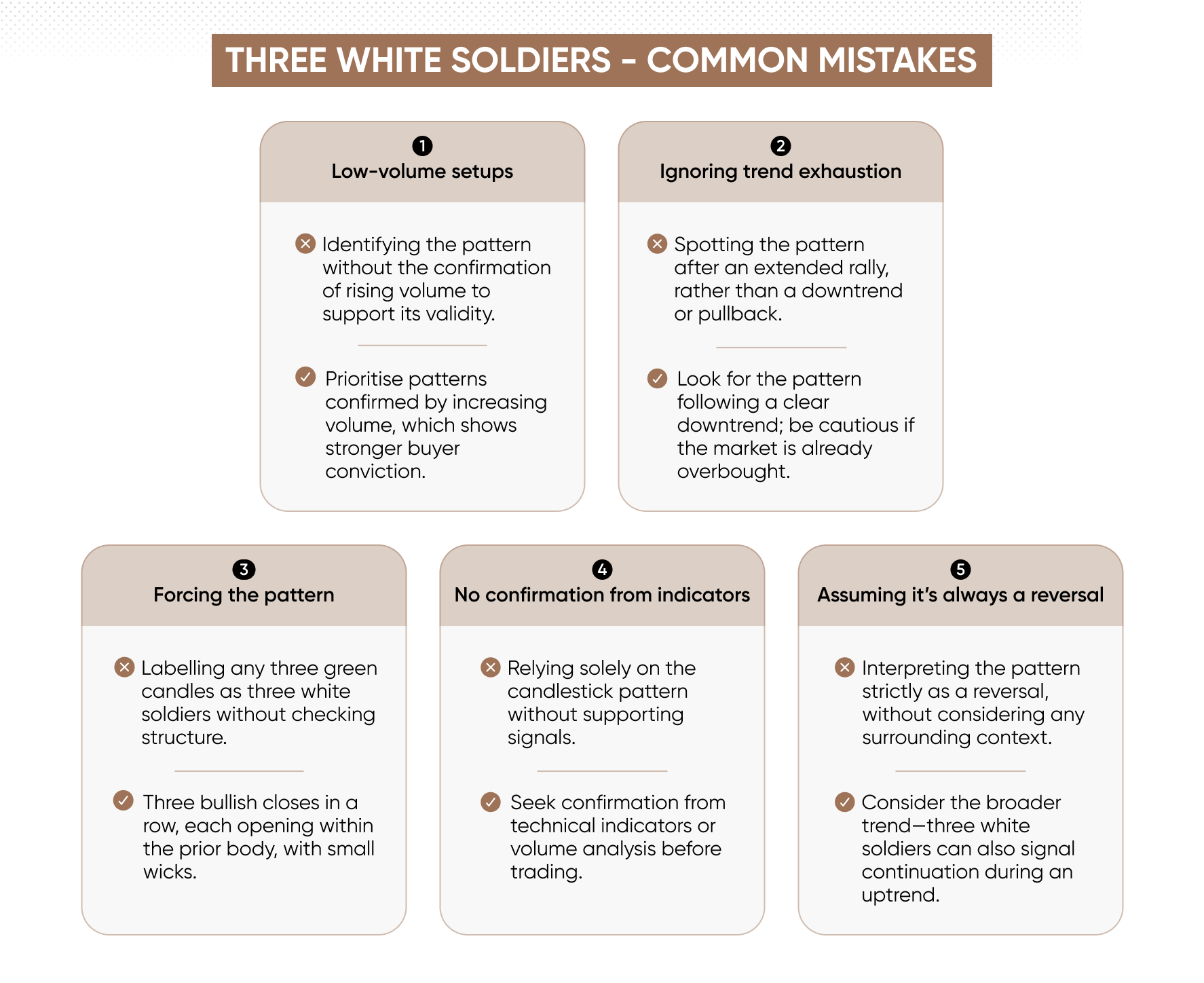

One of the key rules of the three white soldiers pattern is that the candles should have little to no wicks, showing that the price has closed near its high for each period. This demonstrates strong buying pressure and confidence in the uptrend.

Another important rule to remember is that the pattern is most reliable when it appears after a prolonged downtrend, signaling a potential reversal in the market sentiment. Traders often look for confirmation from other technical indicators before entering a trade based on this pattern.

Overall, the three white soldiers candlestick pattern rules can be a valuable tool for traders looking to capitalize on bullish market trends. By understanding the characteristics of this pattern and its significance in the context of market trends, traders can make informed decisions and potentially increase their profitability.

Next time you spot the three white soldiers pattern on a chart, remember to consider the rules and implications of this bullish reversal signal. Happy trading!

What Is The Three White Soldiers Candlestick Pattern Capital Australia

Three White Soldiers Pattern Trading Essentials

Three White Soldiers Key Characteristics And Strategies Alchemy Markets

Three White Soldiers Candlestick Pattern The Essential Guide

Three White Soldiers Definition Formation Trading